2025 Investment Review: A Year of Broadening Horizons

As we close the books on 2025, the over-arching narrative for the global financial markets has been one of diversification and resilience. For the first time in several years, the "U.S. exceptionalism" that defined the post-pandemic era yielded to a more balanced global landscape. While the U.S. remained a pillar of stability, international developed markets and a variety of alternative asset classes stepped out of the shadow of the S&P 500 Index, rewarding those with a truly global perspective.

Equity Markets: The End of U.S. Dominance?

While U.S. markets remained robust, they were no longer the undisputed leaders of the global stage. For the first time in two decades, the S&P 500 Index found itself among the lower-performing major equity indices on a relative basis.

United States: The S&P 500 Index rose approximately 16.4%, closing the year near the 6,850 mark. While historic, this was a cooling compared to the blistering gains of prior years. Market breadth improved as the year progressed, but the Magnificent Seven saw a performance divergence, with only two members outperforming the broader index.

International Developed Markets: The MSCI EAFE Index was a standout performer, gaining nearly 30% in dollar terms. This "International Resurgence" was fueled by a weakening U.S. dollar and attractive valuations in Japan and Germany. Japan, in particular, benefited from corporate governance reforms that pushed profit margins to 20-year highs.

Emerging Markets: Bolstered by a massive rally in Chinese and Korean equities (the latter up over 100% in dollar terms), Emerging Market assets outperformed developed peers, returning roughly 34.4%.

The Fixed Income Landscape and Interest Rates

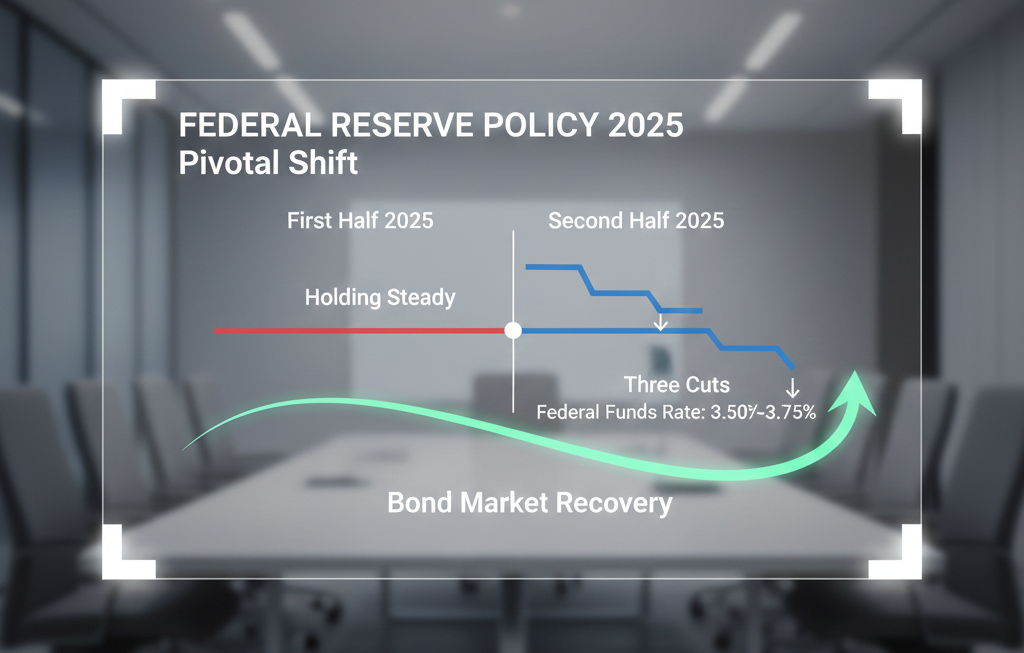

The bond market staged a powerful recovery in 2025, driven by a pivotal shift in central bank policy. After a period of higher-for-longer rates, the focus shifted to "neutral" rates as inflation stabilized.

Global Interest Rates

The Federal Reserve: After holding steady in the first half of the year, the Federal Reserve implemented three cuts in the latter half, bringing the federal funds rate down to a range of 3.50%-3.75%.

Global Divergence: The European Central Bank was more aggressive, cutting rates toward 1.50% to combat stagnant growth, while the Bank of Japan moved against the grain, raising its policy rate to 0.75% (a 30-year high) to manage persistent inflation and yen weakness.

Bond Performance

The Bloomberg U.S. Aggregate Bond Index delivered its best performance since 2020, gaining roughly 7%. U.S. Treasuries benefited from a flight to safety during mid-year trade tensions, with the 10-year yield settling near 4.21%. Credit-sensitive sectors like High Yield and Emerging Market Debt (+13.5%) outpaced government bonds as spreads compressed.

Sector Spotlight: Technology, Healthcare, and Financials

Sector performance reflected a "K-shaped" recovery, heavily influenced by the AI infrastructure buildout and a shifting interest rate environment.

Information Technology: AI remained the dominant theme. NVIDIA surpassed a $4.5 trillion valuation, though investors became more discerning about which software companies could truly monetize the technology.

Financials: This was a banner year for global banks. International financials outperformed as they captured the sweet spot of improved margins in Europe and Japan, alongside a resurgence in global M&A activity.

Health Care: The sector struggled with policy uncertainty and federal spending cuts. However, MedTech was a safe harbor, growing 7% as AI integration in diagnostics and robotics began to yield tangible efficiencies.

The Alt Standard: Dollar, Gold, and Bitcoin

The shift in currency and commodity leadership was perhaps the year's most dramatic story.

The U.S. Dollar: The trade-weighted dollar fell by approximately 9.4%, its worst decline since 2017. This provided a significant tailwind for international returns.

Gold: Precious metals were the stars of 2025. Gold prices soared 55%, surpassing $4,500/oz for the first time. This was driven by aggressive central bank buying (led by China and India) and a desire to hedge against geopolitical entropy.

Bitcoin: It was a year of institutional validation, but high volatility. Bitcoin crossed $120,000 before settling near $88,000. While it gained 15% in real terms, it was ultimately outshone by gold and silver as the preferred "safe haven."

Chief Investment Officer’s Outlook

As we move into 2026, we remain cautiously optimistic at Harbor Ridge Investments. The capex boom in AI and the transition to a more balanced global interest rate environment provide a solid foundation. However, we are watching labor market cooling and rising consumer debt loads closely. Our strategy remains rooted in the lessons of 2025: geographic diversification and a disciplined allocation to real assets are no longer optional.

###

Harbor Ridge Investments (“Harbor Ridge”) is a specialty division of Reflection Asset Management (“RAM”), which is an investment adviser registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940. SEC registration does not constitute an endorsement of the firm by the Commission, nor does it indicate that the adviser or investment adviser representative has attained a particular level of skill or ability.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Harbor Ridge makes no representation or warranty as to the accuracy or completeness of the information, which should not be used as the basis of any investment decision. Information contained on third party websites that Harbor Ridge may link to is not reviewed in their entirety for accuracy and Harbor Ridge assumes no liability for the information contained on these websites. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Harbor Ridge Investments. For more information about Harbor Ridge Investments, including our Form ADV brochures, please visit https://adviserinfo.sec.gov or contact us at bmoszeter@harborridgeinv.com.