Do You Like What You S.E.E. in Your Portfolio?

At Harbor Ridge, we utilize a proprietary process to find the companies we believe are best prepared to demonstrate structural resilience and capitalize on shifting market conditions. We call it the S.E.E. Methodology. It’s a structured, repeatable, scalable way to look beyond the quarterly balance sheet and uncover potential value—and hidden risks—that may be missed by traditional and ESG investing.

Think of S.E.E. as a three-lens telescope that helps us peer beyond today’s headlines to assess a company’s long-term durability and risks.

Products, Services, and Future Profits

Values-oriented investing isn't about avoiding opportunities; it's about re-directing capital to where future profits are most likely to be generated. We believe the next wave of wealth preservation and creation is coming from companies that are actively solving global challenges.

We see the S.E.E. framework applied in two distinct but equally crucial areas:

Product & Service Sustainability: (The external factors—what the company sells.) This is the real growth driver. Companies providing clean energy solutions, sustainable agriculture technologies, or ethical AI platforms are tapping into markets that are expected to grow exponentially due to policy changes, consumer demand, and technological innovation.

Operational Sustainability: (The internal factors—how the company runs its business.) This is covered by the S.E.E. analysis summarized below.

We believe true long-term outperformance comes from investing in businesses that excel in both areas.

The Three Lenses of S.E.E. Analysis

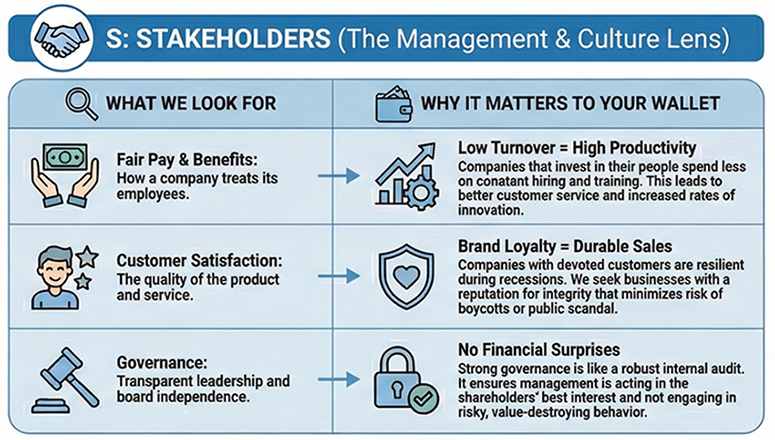

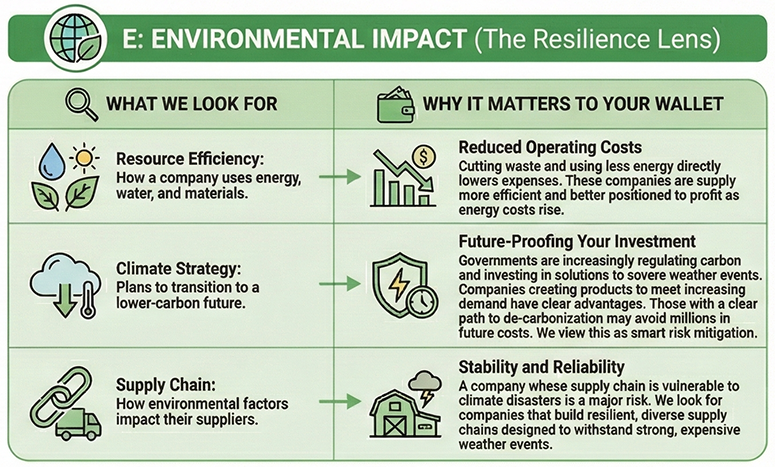

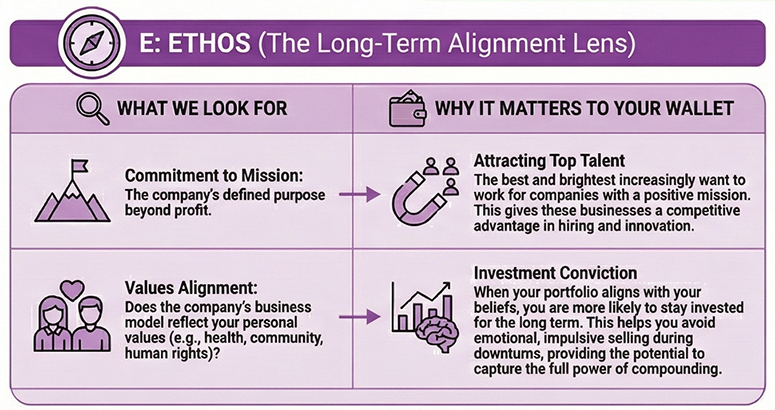

Below, we present a summary of the three lenses—Stakeholders, Environment, and Ethos—revealing the core operational criteria that we believe serve as the most powerful risk mitigators and essential growth drivers of a company’s financial quality.

Smart Investing Redefined: Returns Without Regret

When we apply the S.E.E. filter, we aren't just selecting "nice" companies; we are identifying businesses designed to deliver superior operating characteristics and lower material risk.

Values-oriented investing, through the S.E.E. framework, is simply the next evolution of Smart Investing. It’s how we strive to generate competitive returns and build a future you can be proud to pass down.

###

Harbor Ridge Investments (“Harbor Ridge”) is a specialty division of Reflection Asset Management (“RAM”), which is an investment adviser registered with the Securities and Exchange Commission (“SEC”) under the Investment Advisers Act of 1940. SEC registration does not constitute an endorsement of the firm by the Commission, nor does it indicate that the adviser or investment adviser representative has attained a particular level of skill or ability.

Past performance is not indicative of future results. The material above has been provided for informational purposes only and is not intended as legal or investment advice or a recommendation of any particular security or strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Information obtained from third-party sources is believed to be reliable though its accuracy is not guaranteed, and Harbor Ridge makes no representation or warranty as to the accuracy or completeness of the information, which should not be used as the basis of any investment decision. Information contained on third party websites that Harbor Ridge may link to is not reviewed in their entirety for accuracy and Harbor Ridge assumes no liability for the information contained on these websites. Opinions expressed in this commentary reflect subjective judgments of the author based on conditions at the time of writing and are subject to change without notice. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission from Harbor Ridge Investments. For more information about Harbor Ridge Investments, including our Form ADV brochures, please visit https://adviserinfo.sec.gov or contact us at bmoszeter@harborridgeinv.com.